DeFi aims to recreate financial services like lending, borrowing, trading, insurance and more using decentralized blockchain technology and smart contracts. The DeFi segment that has seen particularly rapid growth is peer-to-peer (P2P) lending platforms. Also referred to as social lending or crowdlending, P2P lending connects individual lenders directly with borrowers to provide credit. Cutting out the intermediary results in better rates for both parties. P2P lending represents an exciting use case for decentralized finance.

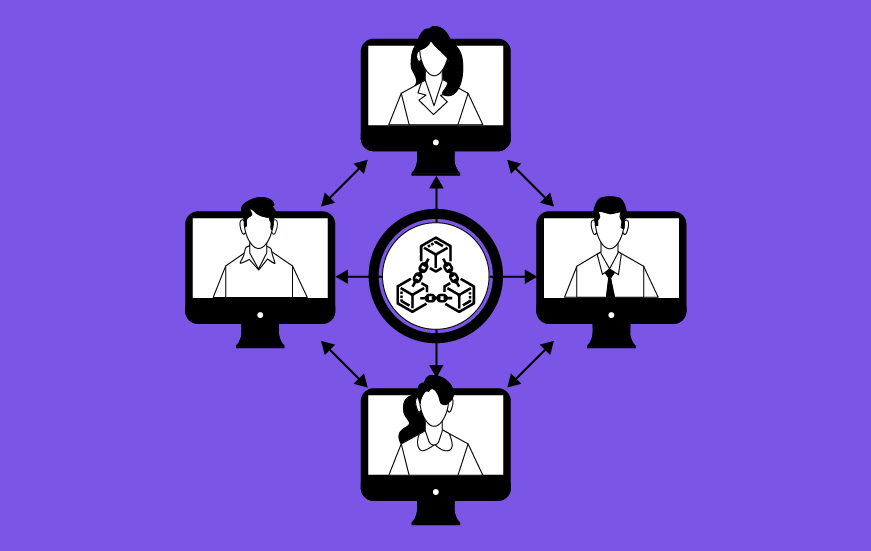

P2P lending platforms use blockchain technology to facilitate lending agreements between peers without centralized intermediaries. Borrowers create loan requests that lenders can opt to fund. Approved loans are then managed by smart contracts. For example, imagine Alice needs a loan of 1000 DAI. She creates a loan request on a DeFi lending platform with her collateral and terms. The different fund parts of the loan with their own DAI. The entire funding and repayment process is handled and enforced by an Ethereum smart contract. There are no banks or brokers involved.

- Access to credit globally – Anyone across the world can access lending capital on DeFi protocols without geography limiting them.

- No intermediaries – DeFi lending involves direct interaction between peers. There are no banks, brokers, or other institutions taking a cut.

- Better interest rates – Borrowers can access lower interest rate loans while lenders earn higher yields on their capital in a P2P model.

- Flexible terms – Borrowers and lenders can customize loan terms like amounts, rates, and collateralization as per their respective needs.

- Transparent contracts – Loan terms are codified transparently in smart contracts visible to all participants.

- No discrimination – DeFi lending is permissionless and doesn’t discriminate based on identity, credit scores, or other exclusionary institutional requirements.

- Financial inclusion – P2P lending grants access to credit and debt capital to the underbanked who otherwise struggle to get loans.

- Instant liquidity – Loan matching and funding can happen almost instantly in DeFi P2P lending without bureaucratic procedures.

- Control over assets – Borrowers retain complete control and ownership of collateral assets throughout the lending process.

- Composability – DeFi lending protocols are interoperable allowing advanced composability across platforms.

Together, these benefits solve many drawbacks associated with traditional lending and make on-chain P2P lending highly attractive for both capital providers and seekers.

Unlocking new lending markets

The most exciting aspect of decentralized P2P lending is that it unlocks new lending markets that previously faced high borrowing costs. For example, borrowers in developing countries struggle to access credit due to the lack of information available to institutions for credit analysis. P2P lending protocols use on-chain data like collateral assets to underwrite loans instead. This allows underbanked borrowers to access loans at reasonable rates. For niche lending markets like student loans or payday loans that carry high-interest rates, retik finance DeFi lending competition provides lower-cost alternatives. By connecting lenders and borrowers directly, DeFi removes layers of intermediary fees and overhead costs that necessitate high-interest rates. The permissionless nature of DeFi lending means that anyone, anywhere with an internet connection participates and benefits from competitive loan markets.